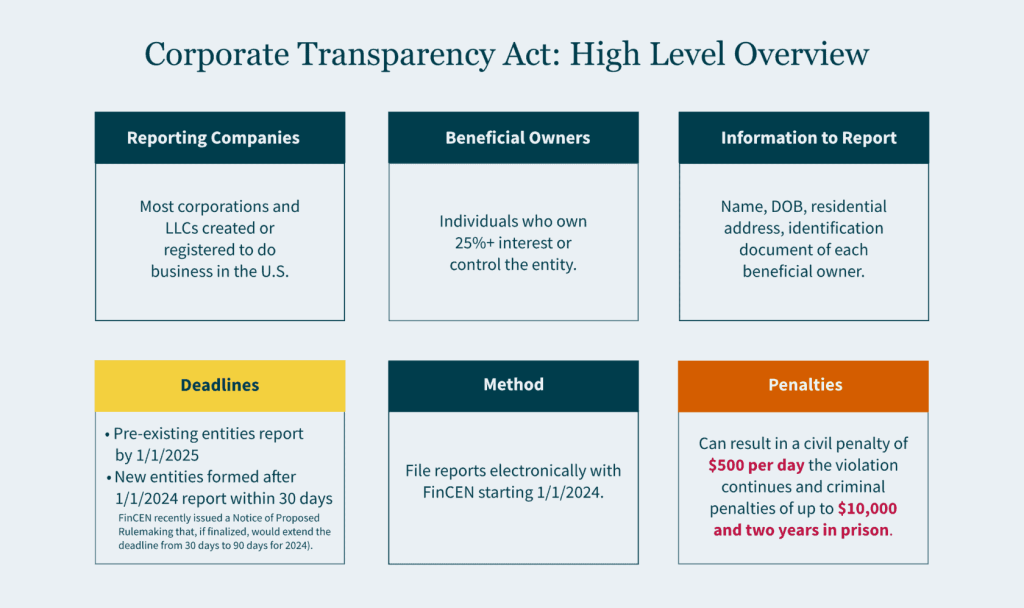

Starting in January 2024, the Corporate Transparency Act will require most entities formed or registered in the United States to report detailed information about their beneficial owners, i.e. the individuals who own or control the company, to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network. (FinCEN)۔

Which organizations are required to be reported?

Basically corporations, limited partnerships (LPs), limited liability companies (LLCs), and entities incorporated in the United States by filing with the Secretary of State (e.g. New York State Department of State) or a similar office. Also, an entity formed under the law of a foreign country and registered to do business in a U.S. state or formed under tribal jurisdiction.

Who doesn’t want to report?

Sole proprietorships, general partnerships, nonprofits, inactive entities (existing on or before January 1, 2020 and not engaged in active business) and certain types of trusts. (There are other organizations that are exempt from reporting requirements.) Check it. here for a list.

What information needs to be reported?

Entities required to comply with the Corporate Transparency Act must file reports with FinCEN including:

Basic information about the entity (corporation or LLC);

Some information about its beneficial owners (individuals who have substantial control over the entities, or own or control at least 25% of the business ownership interests). اور

Company applicants (who file to form a company).

What information should be provided about the beneficial owners?

For each person who is the beneficial owner, the following information must be provided:

the name of the person;

the date of birth;

a residential property; and

Identifying number from an acceptable identification document, such as a passport or U.S. driver’s license, and the name of the state or jurisdiction issuing the identification document with a photo of such document.

When do companies have to report to FinCEN?

Existing entities created or registered to do business in the United States before January 1, 2024, must file a preliminary report by January 1, 2025.

Entities created or registered on or after January 1, 2024, and before January 1, 2025, will have 90 days to file an initial beneficial ownership information report.

An entity created or registered after January 1, 2025, will have 30 days to file an initial beneficial ownership information report.

Read It The Patient Protection and Affordable Care Act

There will be a fee?

No, there will be no fee for submitting a benefit ownership information report to FinCEN.

Is it necessary to file an annual report with FinCEN?

No, reports will only need to be entered when there is a change. Previously reported information about any entity or beneficial owners. Reports are received within 30 days of the change.

How do companies report to FinCEN?

The institutions have to report the required information electronically. The website of FinCEN.

What happens if an entity does not report beneficial ownership information to FinCEN or fails to update or correct the information in a timely manner?

There are both civil and criminal penalties for individuals who knowingly provide false information or intentionally fail to report complete or updated beneficial ownership information to FinCEN. The penalties for non-compliance are severe and include significant fines and imprisonment of up to two years.

Leave a Reply